Free Supplier Risk Scorecard Download

Download our free supplier risk scorecard here!

Download the free tool!AI Summarize:

Efficiency and control over spending are more crucial than ever. Enter the corporate purchasing card (P-card), a specialized financial tool designed to streamline procurement processes, enhance financial reporting, and offer significant strategic advantages. This comprehensive guide delves into the multifaceted world of P-cards, comparing them with traditional credit options, exploring their benefits, and outlining steps for successful implementation.

What is a Corporate Purchasing Card?

Corporate purchasing cards streamline the procurement process by reducing complexity, cost, and time. Unlike personal credit cards, these cards are linked to the company's account, providing real-time visibility and control over expenses. They aim to lower the traditional procurement process's administrative costs, processing costs, and transaction costs.

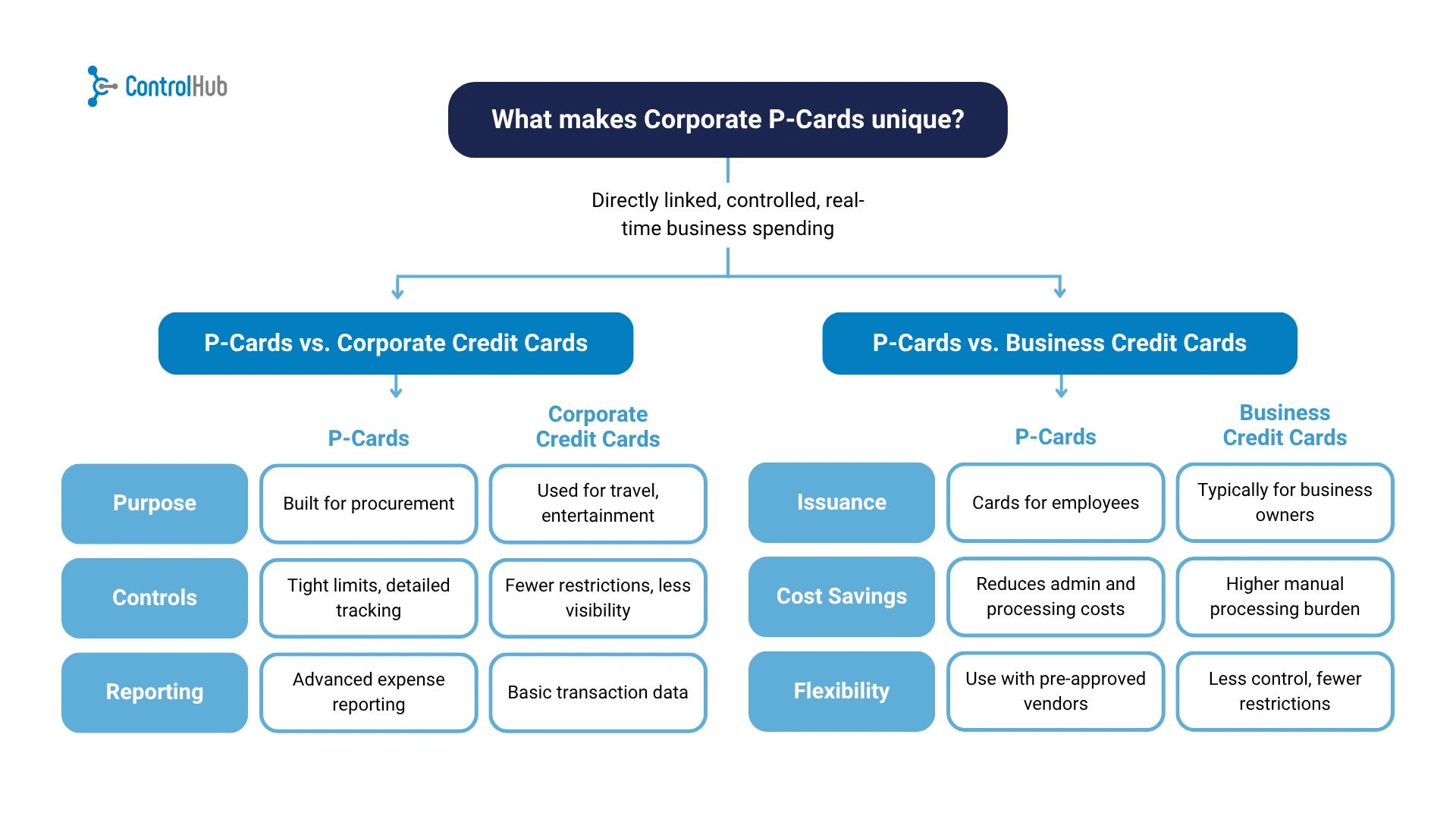

What makes Corporate P-Cards unique?

Corporate purchasing cards differ from personal credit cards, business credit cards, and corporate credit cards in key ways. They are directly linked to the company's financial systems, allowing financial controllers to monitor spending in real time, enforce expense policies, and ensure that payments to suppliers are made efficiently, reducing the risk of fraudulent transactions. This direct link also facilitates better control over spending, with the ability to track expenses, manage the payable process, and streamline expense reconciliation without the need for paper receipts.

P-cards vs. Corporate Credit Cards

P-cards are tailored for procurement, offering limits and controls to manage spending, contrasting with corporate credit cards designed for travel and entertainment with less detailed transaction control. Business credit cards, used by small businesses or individuals, lack the sophisticated reporting and control features of P-cards, making P-cards a superior solution for companies aiming to reduce operating costs and streamline their purchasing processes.

P-cards vs. Business Credit Cards

P-cards enable business owners to issue individual cards to employees, simplifying the procurement process and payment process by bypassing traditional purchase methods. The use of these cards reduces administrative costs associated with the accounts payable process, lowers processing costs, and minimizes transaction costs related to business purchases, including online purchases. The flexibility provided by P-cards, including the use of pre-approved vendors, enhances the company's spending flexibility while reducing the operational burden on financial systems.

How Corporate Purchasing Cards Streamline Procurement and Controls?

Purchasing cards (P-cards) provide a strategic advantage by streamlining the procurement process. They allow individual employees to make direct transactions for business spending without the cumbersome traditional purchase request process.

This simplification leads to significant cost savings by cutting down on administrative overhead related to requisition forms and purchase order processing. P-cards offer robust controls, enabling finance departments to set spending rules that ensure purchases align with company policies.

Boosting Financial Reporting and Compliance

P-cards automate the reporting processes, from employee purchases to vendor payment, providing finance leaders with detailed insights into business spending. This automation improves the accuracy of financial reporting, allowing for more informed decisions.

By streamlining invoice processing and eliminating paper invoices, P-cards offer long-term value in terms of both cost savings and environmental impact. Compliance with corporate spending policies and external regulatory requirements is ensured, as P-cards enable finance departments to easily track spending trends and enforce robust controls.

Mitigate Risks

The automation within P-card systems provides critical fraud protection by flagging unusual spending patterns and preventing unauthorized transactions. This major difference from personal credit cards or traditional credit options is a significant advantage, particularly for startups and businesses looking to protect their credit score.

Enhanced security features not only reduce the risk of fraudulent transactions but also contribute to overall business efficiency. By automating the payables process, P-cards eliminate the need for paper-based purchase requests and invoice processing, further reducing the risk of errors and fraud.

Simplifying Expense Management

The centralization of transactions via P-cards simplifies the management of business expenses. This consolidation aids in streamlining the reconciliation process, significantly reducing the time and effort required by finance teams to match expenses with budget allocations. Additionally, P-cards eliminate the complexity of handling multiple payment processes by providing a unified platform for all transactions.

This simplification leads to more efficient expense tracking, allowing companies to monitor and analyze spending patterns accurately. As a result, businesses can identify potential savings, improve budget planning, and enforce spending policies more effectively. The reduction in manual data entry and paperwork further decreases the likelihood of errors, enhancing the overall accuracy of financial reports.

How to Implement a Successful Purchasing Card Program?

Key Steps for a Smooth P-Card Setup

Starting a P-card program means looking at how your business buys and pays for things. Here's what you need to do:

- Check Your Current Buying and Paying Methods:

Business owners should first review how they currently buy goods and services and how they pay for these. This helps spot where P-cards can make things faster and cheaper.

- Set Clear Goals:

Knowing what you want from your P-card program is important. This usually means wanting to cut down on costs like how much you spend on processing, administration, and transactions. It also means making it easier for your business to buy what it needs when it needs it.

- Choose the Right P-Card Provider:

Picking a provider is a big deal. You want one that offers the types of cards you need, like debit cards, credit cards, or business charge cards. The provider should fit well with your business's financial setup and accounting software, making everything work together smoothly.

- Make Clear Rules:

You need to set up rules for using P-cards. This includes how much can be spent, who you can buy from (like pre-approved vendors), and what you can buy. Making these rules clear helps avoid confusion and misuse.

- Train Your Team:

Finally, anyone using a P-card must know how to use it properly. This means training sessions that cover the rules, how to make purchases, and how to avoid scams.

How to Pick the Right P-Card Provider

When it’s time to choose a P-card provider, the decision affects how you pay for things and manage money. Business owners need to look at different providers to find one that fits their needs. Here's what to focus on:

- Variety of Card Options:

Find a provider that has a range of card types. Some employees might need individual cards, while other times you might need cards with no spending limit. Check if they offer prepaid cards, debit cards, and credit cards.

- Integration with Your Systems:

The provider should work well with your current financial and accounting systems. This makes it easier to manage expenses and payments without extra hassle.

- Real-Time Spending Tracking:

Choose a provider that lets you see spending as it happens. This helps you keep a close eye on where the money's going, understand spending patterns, and cut down on unnecessary costs.

- Help with Saving Time and Money:

The right provider will help make buying and paying for things more efficient. This means less time and money spent on administrative tasks and processing.

Free Supplier Risk Scorecard Download

Download our free supplier risk scorecard here!

Download the free tool!The Future of Procurement: Digital Software and Advanced Capabilities.

Today’s P-cards bring together the best of both worlds: the tight oversight of traditional purchase cards and the user-friendly nature of corporate cards. This mix results in a powerful tool for businesses. Here’s how:

- Enhanced Spend Management: Modern P-cards come with features that allow businesses to manage spending closely. Users can set specific limits on where, when, and how cards are used, providing a way to control costs effectively.

- Seamless Accounting Integration: These cards are designed to work directly with your company’s accounting software. This means less time spent on manual data entry and more time available for strategic financial planning. The integration also simplifies expense tracking and reporting, making it easier to monitor and analyze spending patterns.

- Instant Reporting and Insights: One of the standout features of modern P-cards is the ability to report transactions in real-time. This immediacy offers businesses a clear, up-to-the-minute view of their financial activities, aiding in quick decision-making and financial transparency.

By incorporating these advanced features, modern P-cards are revolutionizing procurement processes. They streamline operations, reduce administrative burdens, and offer strategic insights into spending, shaping the future of how businesses manage their expenses.

Free Supplier Risk Scorecard Download

Download our free supplier risk scorecard here!

Download the free tool!Free Supplier Risk Scorecard Download

Download our free supplier risk scorecard here!

Download the free tool!Free Supplier Risk Scorecard Download

Download our free supplier risk scorecard here!

Download the free tool!Key Takeaways

- Streamlined Buying: P-cards cut through the red tape of purchasing. This means your team can get what they need quickly without waiting for long approval processes.

- Better Reporting: With P-cards, you get detailed reports on what's being bought, by whom, and for how much. This makes it easier to see spending patterns and ensure compliance with company policies.

- Improved Financial Control: You have more control over your business's money. You can set limits on spending and track purchases in real time, helping to prevent fraud and overspending.

.png)